Ira Income Limits 2025 - Traditonal Ira Contribution Limits 2025 Piers Piper, The 2025 roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly. Traditional Ira Contribution Limit 2025 Jolyn Madonna, The roth ira contribution limits are $7,000, or $8,000 if you're.

Traditonal Ira Contribution Limits 2025 Piers Piper, The 2025 roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly.

Ira Limits 2025 For Deduction 2025 Dan Tucker, The amount you can contribute to a roth ira might be less than the year’s ira contribution limit (and possibly $0) if your income is above a certain.

Roth Ira Limits 2025 Mfj Claire Paige, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

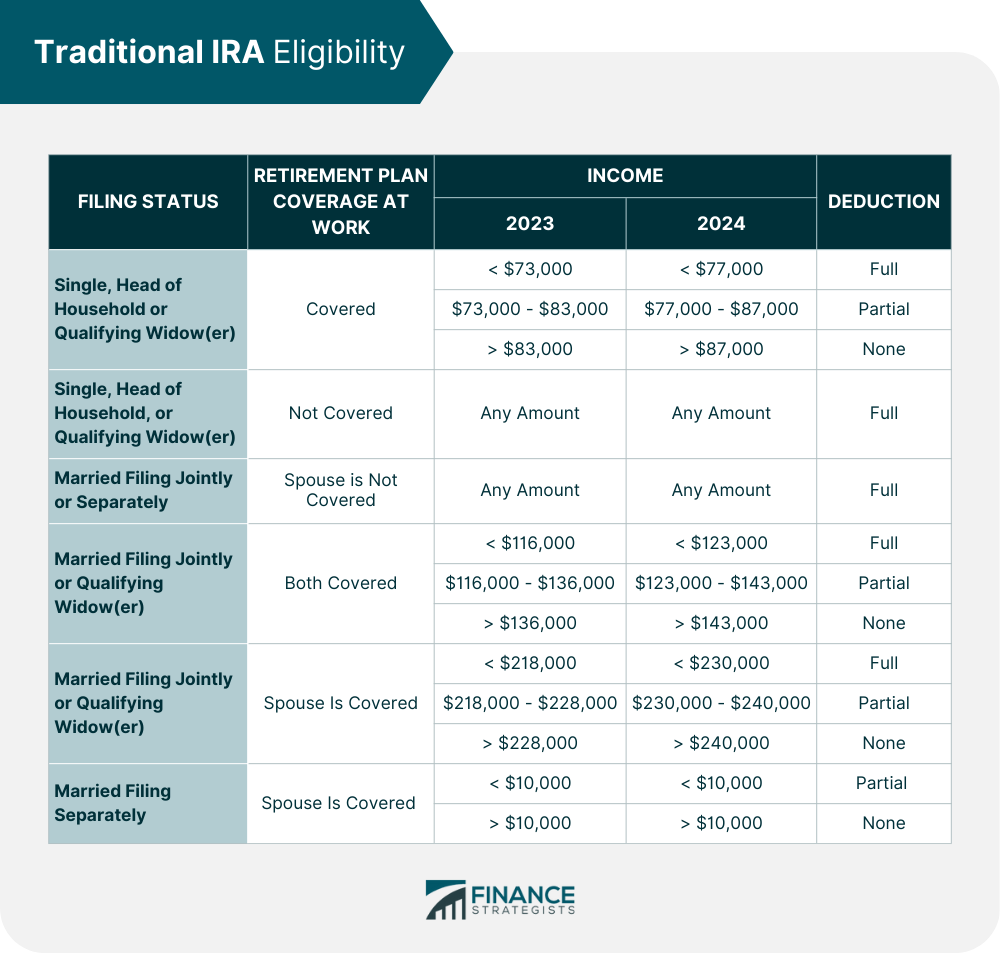

Ira Income Limits 2025. The table below shows the income limits for 2025 and 2025 for making roth contributions. Roth ira income limits for 2025.

Roth Ira Limits 2025 Tax Sue Burgess, The ira contribution limits are $7,000 in 2025, or $8,000 for those 50 and older.

Ira Limits 2025 For Simple Tax Verna Horvath, The ira contribution limits are $7,000 in 2025, or $8,000 for those 50 and older.

Ira Limits 2025 Contribution Penelope Gibson, Unlike the roth ira, the amount that you can contribute to your traditional ira doesn't.

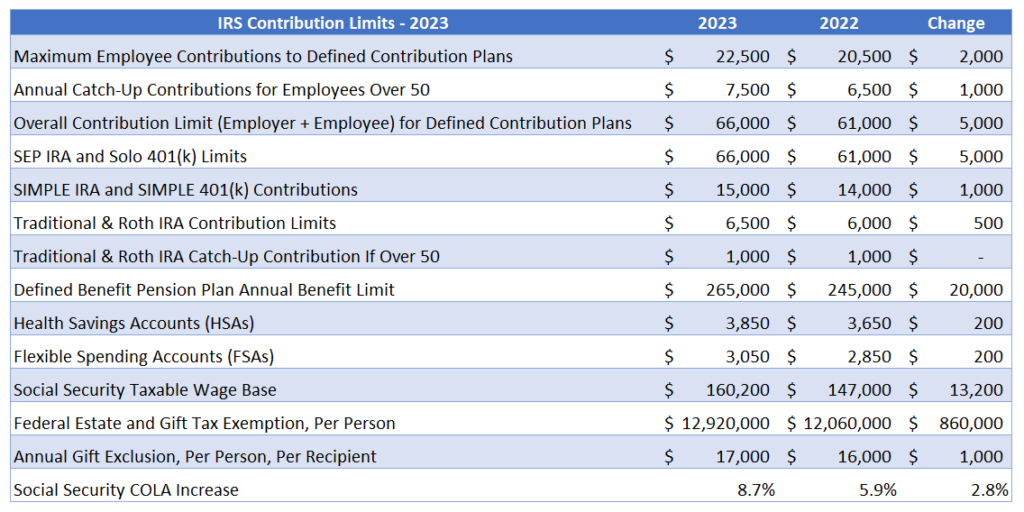

The IRS announced its Roth IRA limits for 2025 Personal, In 2025, the simple ira limit is $16,000 for employee deferrals, with another $3,500 allowed for individuals age 50 or older.

The announcement is tied to cost‑of‑living adjustments for. The internal revenue service (irs) recently issued the retirement plan limits for the 2025 year, detailed in the chart linked to below.

Traditional Ira Limits 2025 2025 Donna Dowd, The irs adjusts the ira contribution and.