Roth 401 K Contribution Limits 2025 - Roth 401 K Contribution Limits 2025. Employees age 50 and older can contribute an additional $7,500 for a total of $31,000. Starting in 2025, you can save up to $23,500 in your roth 401 (k). 2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, Employees age 50 and older can contribute an additional $7,500 for a total of $31,000.

Roth 401 K Contribution Limits 2025. Employees age 50 and older can contribute an additional $7,500 for a total of $31,000. Starting in 2025, you can save up to $23,500 in your roth 401 (k).

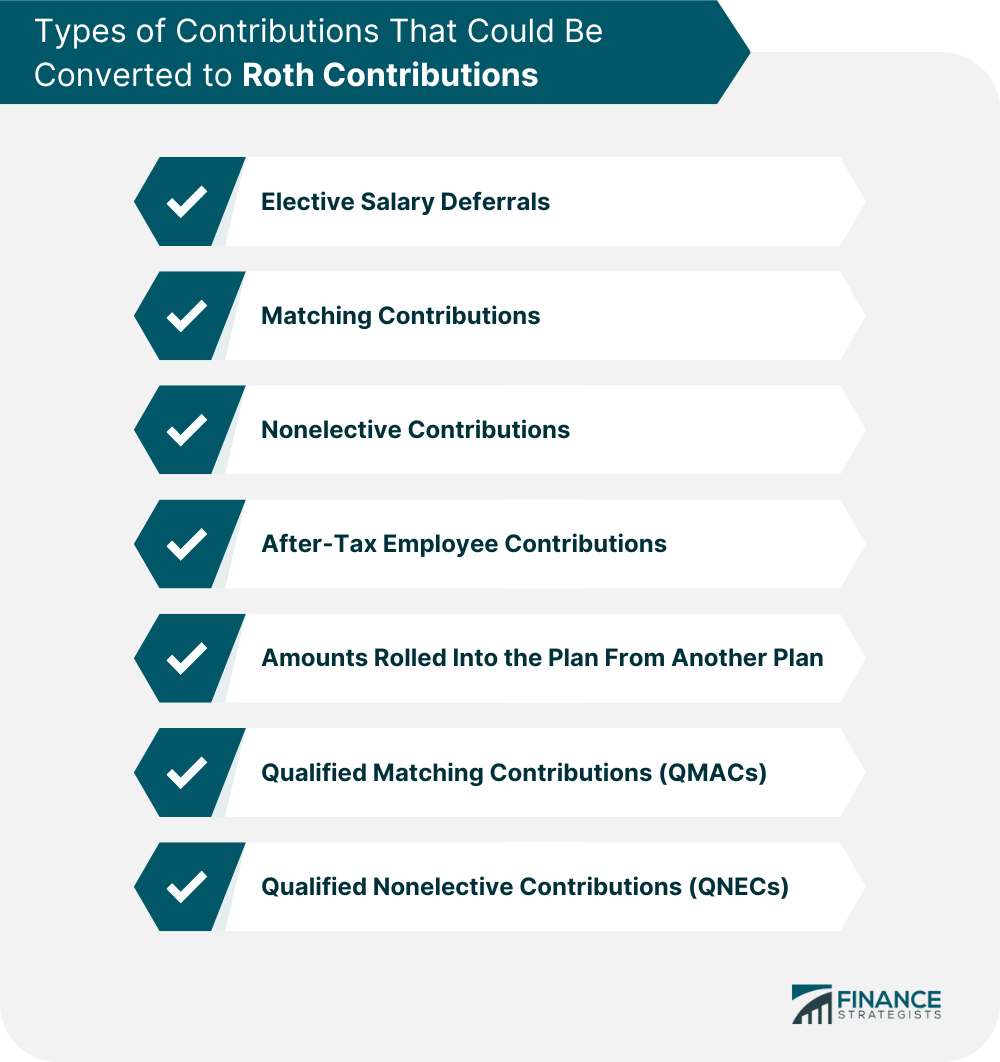

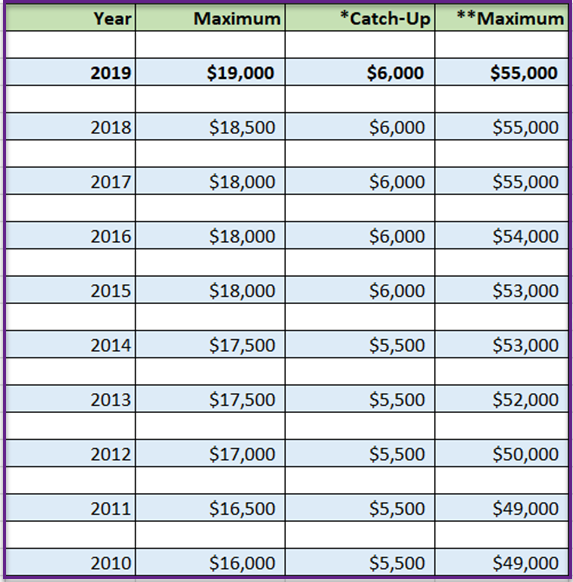

For 2025, the 401 (k) limit for employee salary deferrals is $23,500, which is above the 2025 401 (k) limit of $23,000. A lot has changed since the 401(k) first came onto the scene in 1978.

Roth 401k Contribution Limits 2025 Sella Daniella, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, A lot has changed since the 401(k) first came onto the scene in 1978.

401k Roth Ira Contribution Limits 2025 Mary Anderson, Employees age 50 and older can contribute an additional $7,500 for a total of $31,000.

2025 401k Roth Contribution Limits 2025 Max Bower, The total maximum allowable contribution to a defined contribution plan (including both employee and employer.

2025 Roth 401 K Contribution Limits Farica Shelagh, The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution.

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

2025 401k Roth Contribution Limits 2025 Isaac Gray, That's on top of the standard $23,500 limit for.

2025 401k Roth Contribution Limits 2025 Isaac Gray, You can contribute a maximum of $7,000.